“`html

Unleashing the Power of AI for Fraud Detection: A Modern-Day Lifesaver in Financial Security

Estimated reading time: 10 minutes

Key Takeaways

- AI for fraud detection is revolutionizing financial security.

- AI in financial fraud prevention enhances precision and efficiency over traditional methods.

- AI-powered risk assessment allows a proactive stance against fraud.

- AI amplifies online security by preventing online fraud.

- AI-driven identity verification is crucial against identity theft.

- Challenges exist in deploying AI for fraud detection, including data privacy and algorithm bias.

- Implementing AI-based fraud prevention tools requires careful planning.

- Embracing AI for fraud detection is necessary for robust financial security.

Table of Contents

- Unleashing the Power of AI for Fraud Detection: A Modern-Day Lifesaver in Financial Security

- Key Takeaways

- Understanding AI in Fraud Detection

- AI-Powered Risk Assessment: A Proactive Stance against Fraud

- Credit Card Security Fortified with AI

- How AI is Building a Robust Wall against Online Fraud

- AI-Driven Identity Verification: A Fortress against Identity Theft and Account Takeover

- AI’s Vast Role in Risk Management

- Implementing AI-Based Fraud Prevention Tools: A Guide

- Tangible Benefits of AI for Fraud Detection

- Challenges and Considerations: A Balanced View

- Conclusion: Embrace AI for Fraud Detection

- Frequently Asked Questions

In the perpetual cat and mouse game of fraud prevention, AI for fraud detection is emerging as the game-changing technology. As swindlers adapt and refine their techniques, AI technologies have become indispensable tools equipping businesses with the penultimate shield against fraudsters and securing their assets and clientele base.

These AI-powered tools and strategies have revolutionized financial security, particularly in AI in financial fraud prevention and AI-powered risk assessment, instilling confidence in businesses and consumers alike.

Understanding AI in Fraud Detection

To elucidate, AI in financial fraud prevention refers to the deployment of cutting-edge artificial intelligence technologies for identifying, scrutinizing, and curbing fraudulent activities within financial ecosystems. Artificial Intelligence trumps the traditional tactics by enhancing the precision and efficiency of fraud detection manifold.

Based on the research provided by Financial Crime Academy, AI for fraud detection employs sophisticated machine learning algorithms to analyze copious amounts of data in real-time, spotting patterns and anomalies that may suggest fraudulent activities.

Unlike their traditional counterparts that function on rule-based systems, AI technologies adapt to evolving fraud tactics and constantly upgrade their detection capacities, making them well nigh foolproof. For those interested in how to build AI without coding, this adaptability showcases the versatility and accessibility of modern AI solutions.

AI-Powered Risk Assessment: A Proactive Stance against Fraud

AI-powered risk assessment is the panacea for financial institutions, empowering them to dynamically evaluate potential financial risks. Benefits of using AI for risk assessment are aplenty – from analyzing multiple data points simultaneously to adapting to changing fraud patterns and reducing false positives, as detailed by the DigitalOcean research. This adaptability makes AI indispensable in risk management strategies.

Integrating AI into fintech investing further enhances risk assessment by leveraging advanced technologies to predict and mitigate potential investment risks.

Credit Card Security Fortified with AI

AI credit card fraud detection systems play a crucial role in fortifying credit card transactions. These systems identify and hinder suspicious activities by analyzing real-time transaction patterns and spotting discrepancies based on individual user behavior, Emb Global Blog confirms. Thus, AI in financial fraud prevention extends its reach to safeguard credit card transactions.

For those managing personal finances, integrating personal finance fundamentals can complement AI-driven fraud detection by ensuring a holistic approach to financial security.

How AI is Building a Robust Wall against Online Fraud

AI steps up online security by preventing online fraud, especially in securing online transactions. Core mechanisms employed by AI in this arena include behavioral analysis, device fingerprinting, and network analysis as per Tookitaki. AI amplifies online security by integrating with existing digital security infrastructures to provide a multilayered defense against varied digital fraud forms.

Leveraging the latest tech gadgets can further enhance online security measures by incorporating innovative hardware solutions alongside AI software.

AI-Driven Identity Verification: A Fortress against Identity Theft and Account Takeover

AI-driven identity verification is paramount to preventing identity theft and account takeover attempts. Technologies such as facial recognition, biometric analysis, and multi-factor authentication detailed in the study by Mastercard Press, fortify the security while maintaining seamless user experience. Clearly, the role of AI in bolstering financial fraud prevention extends to robust identity verification measures.

AI’s Vast Role in Risk Management

AI’s reach in risk management goes beyond fraud detection, extending to a comprehensive risk mitigation strategy for financial institutions according to the Artiba Blog. AI systems predict potential risks based on market trends and historical data, optimizing resource allocation and providing real-time decision-making insights.

Implementing AI-Based Fraud Prevention Tools: A Guide

To leverage AI fraud detection solutions, it is imperative to consider the following steps:

- Assess your current fraud detection abilities and identify gaps.

- Identify specific areas where AI can bolster your detection efforts.

- Choose AI tools and vendors that align with your existing systems and business needs.

- Invest in training your staff to maximize the advantages of AI.

Another vital aspect to consider is the ongoing evaluation and revision during the implementation process to ensure the system’s efficacy.

Tangible Benefits of AI for Fraud Detection

Adopting AI in fraud detection brings about several benefits, including enhanced accuracy in identifying fraud, faster response times to potential threats, cost-saving automation, improved efficiency, and strengthened customer trust as mentioned in MindBridge AI Blog.

Challenges and Considerations: A Balanced View

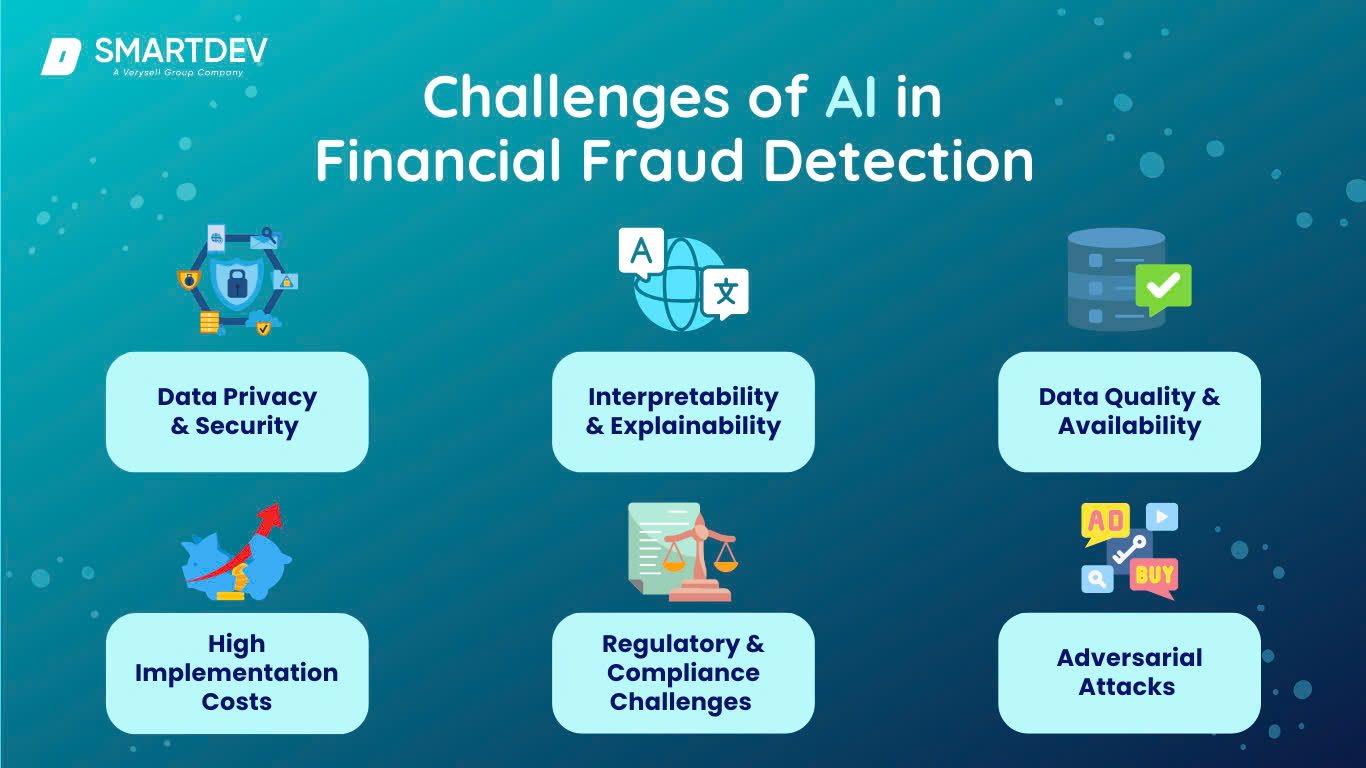

Despite its many advantages, deploying AI for fraud detection poses challenges such as ensuring data privacy, maintaining transparency in AI’s decision-making processes, addressing biases in AI algorithms, and overcoming implementation complexities. Effective strategies to overcome these hurdles include conducting regular algorithm audits, transparent data usage, and a collaboration between IT and compliance teams.

Conclusion: Embrace AI for Fraud Detection

The significance of AI for fraud detection is undeniable. Its pivotal role in modern financial security underscores the benefits of implementing AI-based fraud prevention tools. By leveraging the advanced machine learning techniques, financial institutions can outsmart increasingly prevalent and sophisticated fraudulent tactics. Moreover, with continuous advancements in AI technology, we can anticipate more versatile and potent fraud prevention solutions.

In today’s digital landscape, the exploration and adoption of AI-powered solutions transitions from being merely optional to an absolute necessity. By embracing these technologies, organizations can not only strengthen their defenses against fraud but also improve operational efficiency and enhance customer trust.

So, if you’re gearing up to fortify your financial security, don’t think twice – embrace AI-based tools for robust fraud prevention.

Frequently Asked Questions

Q: How does AI improve fraud detection in financial institutions?

A: AI enhances fraud detection by utilizing machine learning algorithms to analyze vast amounts of data in real-time. It identifies patterns and anomalies indicative of fraudulent activities more accurately and efficiently than traditional rule-based systems.

Q: What are the challenges in implementing AI for fraud detection?

A: Challenges include ensuring data privacy, maintaining transparency in AI decision-making processes, addressing potential biases in AI algorithms, and overcoming the complexities involved in integrating AI systems with existing infrastructures.

Q: Is AI-based fraud prevention suitable for small businesses?

A: Yes, AI-based fraud prevention tools can be scaled to suit businesses of all sizes. They help small businesses protect themselves against fraud by providing advanced detection capabilities that were previously accessible only to larger enterprises.

“`

2 Comments