Everything You Need to Know About Fintech Investing

Estimated reading time: 7 minutes

Key Takeaways

- Fintech investing integrates technology with financial services, transforming traditional investment practices.

- Increased efficiency and accessibility are key benefits of fintech solutions.

- Robo-advisors and AI enhance investment strategies through automation and predictive analytics.

- Security and regulatory compliance are critical in the fintech investing landscape.

- The future of fintech investing includes advancements in blockchain technology and AI.

Table of Contents

- Everything You Need to Know About Fintech Investing

- Key Takeaways

- What is Fintech Investing?

- Robo-Advisors: The Automated Investment Managers

- Digital Wealth Management Solutions

- Exploring Online Investment Platforms

- The Role of AI in Investing

- Integrating Fintech Solutions for Enhanced Investment Strategies

- Security and Regulation in Fintech Investing

- Pros and Cons of Fintech Investing

- Future Outlook of Fintech Investing

- Conclusion

Fintech investing, the harmonious integration of technology into financial services, is significantly transforming the landscape of traditional investment practices. It is reshaping the way investors make, manage, and grow their wealth. The rise of tech-driven investment strategies has sparked a growing interest and adoption by individual investors and institutions alike. At the heart of fintech investing is the mission to make investment opportunities more accessible and efficient for all, revolutionizing the entire financial spectrum. Research findings support this transformation, emphasizing the importance of fintech solutions in the modern financial landscape.

What is Fintech Investing?

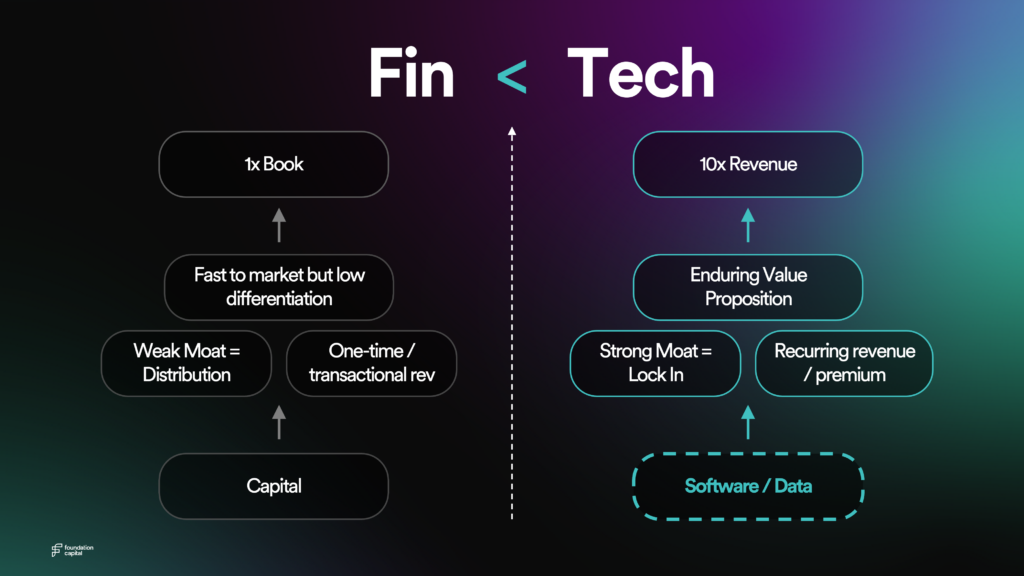

At its core, fintech investing is the innovative use of technology to enhance and streamline investment services and products. It offers stark contrasts with traditional investing, which relies heavily on manual processes and human advisors. By leveraging automation, algorithms, and digital platforms, fintech investing achieves greater efficiency, speed, and lower costs. Increased accessibility for a broader range of investors, as outlined by the Central Bank of Ireland, is another significant benefit of fintech solutions.

Robo-Advisors: The Automated Investment Managers

A key player in fintech investing are robo-advisors. Defined by Morningstar as digital platforms, they offer automated, algorithm-driven financial planning with minimal human intervention. They manage investment portfolios based on individual investor profiles and utilize advanced algorithms for tasks like risk assessment, investment goal evaluation, and market condition analysis.

Robo-advisors also bring their own set of benefits. Their low fees make them attractive to investors. They allow even those with smaller account balances to access high-quality financial planning services and provide consistent, emotion-free investment management.

Popular robo-advisor platforms include Betterment, Wealthfront, and Vanguard Digital Advisor. Each offers a unique set of services tailored to the specific investment needs and goals of its users.

Digital Wealth Management Solutions

Enhancing the fintech investing ecosystem are comprehensive digital wealth management solutions. They provide personalized financial planning and investment management through digital means. Key components of these platforms, supported by evidence from The Financial Technology Report, include personalized investment strategies, goal-based planning tools, and integration with other financial accounts.

Digital tools contribute significantly to improving wealth management strategies. They utilize data analytics to provide tailored advice and enhance user experience with intuitive interfaces and real-time tracking. They offer more significant benefits over traditional wealth management services, including accessibility, lower costs, and enhanced personalization through technology.

Exploring Online Investment Platforms

Online Investment Platforms are digital services that allow users to buy, sell, and manage investments such as stocks, ETFs, and mutual funds through internet-based interfaces. They offer easy account setup and management, access to a large variety of investment options, and tools for portfolio tracking and performance analysis.

However, not all platforms are equal. When choosing an online platform, look for a user-friendly interface, low fees, transparent pricing, robust security, and comprehensive customer support.

The Role of AI in Investing

Another noteworthy mention in fintech investing is the role of artificial intelligence (AI). AI in investing essentially refers to the use of complex algorithms to enhance investment decision-making and predictive analytics. AI-driven tools can evaluate vast amounts of data to identify trends and opportunities, leading to superior risk assessments. Yieldstreet supports this notion, showing how AI provides personalized investment advice and automates complex investment strategies, leading to better efficiency.

Integrating Fintech Solutions for Enhanced Investment Strategies

Creating a comprehensive and efficient investment strategy involves the synergistic use of several fintech solutions. You might use robo-advisors for automated portfolio management, digital wealth management for financial planning, and AI tools for advanced data analysis and predictive insights. This strategy allows you to leverage the unique benefits of each tool, enabling you to meet your financial goals effectively.

However, integrating these technologies can present challenges, including technical compatibility and data security issues. Overcoming these challenges involves choosing integrated platforms, providing user education and support, and implementing robust security measures.

Security and Regulation in Fintech Investing

With the rising popularity of fintech investing, the importance of cybersecurity and regulatory compliance cannot be overstated. Regulations like Anti-Money Laundering (AML) and Know Your Customer (KYC) requirements ensure transparency in investing and protect financial data – all of which are supported by insights from Investopedia.

Pros and Cons of Fintech Investing

Like all investment strategies, fintech investing comes with its pros and cons. On the advantage side: enhanced accessibility, lower costs, increased efficiency and automation, and personalized investment strategies. On the flip side, potential drawbacks include dependence on technology, limited human interaction, security concerns, and algorithmic decision-making risks.

Future Outlook of Fintech Investing

In the world of fintech investing, we’re seeing emerging technologies that are shaping the future of this industry. Advancements in blockchain technology and AI, along with the expansion of sustainable investing options, are among the key trends identified by MTU University.

Conclusion

By revolutionizing traditional financial services, fintech investing is democratizing access to sophisticated investment tools. Technology, combined with astute financial wisdom, has the potential to shape the future of investing, leading to more efficient, accessible, and successful financial strategies.

Call to Action

Interested in exploring fintech investing further? Then stay informed by subscribing to our blog for more insights and updates. Remember – sharing is caring! Share this blog post on social media and let others tap into the world of fintech investing.

2 Comments